Are Home Prices Going To Tank?

It's impossible to not hear someone's opinion these days about the economy and what's going on with home prices. Loud mouths on the news, Facebook, heck, even your drunk Uncle Joe, all seem to have all the answers these days. But while your uncle might be good for uncomfortable jokes, chances are he really doesn't know what he is talking about with where home prices are going.

Sure there is uncertainty about the economy, triggered by a potential trade war but you need to listen to experts in the housing and lending world. Many people are dragging their feet in purchasing their new home or their dream home because "someone" said they think home prices are going to fall over the next few years. But, the experts disagree. And this is why I listen to experts because, well...they are experts and your drunk Uncle Joe is just that. But he is still your uncle. But I digress.

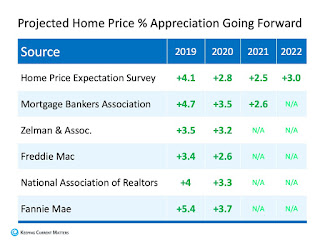

Here is a table showing the predicted levels of appreciation from six major housing sources:

Sure there is uncertainty about the economy, triggered by a potential trade war but you need to listen to experts in the housing and lending world. Many people are dragging their feet in purchasing their new home or their dream home because "someone" said they think home prices are going to fall over the next few years. But, the experts disagree. And this is why I listen to experts because, well...they are experts and your drunk Uncle Joe is just that. But he is still your uncle. But I digress.

Here is a table showing the predicted levels of appreciation from six major housing sources:

As you can see, every source believes home prices will continue to appreciate (though at somewhat lower levels than we have seen over the last several years). But, not one single source is predicting for residential real estate values to depreciate.

Additionally, ARCH Mortgage Insurance Company in their current Housing and Mortgage Market Review revealed their latest ARCH Risk Index, which estimates the probability of home prices being lower in two years. There is not one single state that even had a moderate probability of home prices lowering. In fact, 34 of the 50 states had a minimal probability.

And yes, your Uncle Joe was wrong again...there are only 50 states.

Bottom Line

Those waiting for prices to fall before purchasing a home should realize that the probability of that happening anytime soon is next to nothing. With mortgage rates already at near historic lows, now is the time to act.

Scott' Advice

You should listen to many sources of info but go to the experts for the best advice when it come to where the housing market is going. The longer you wait, the higher prices will go. And there is no guaranty how long mortgage rates will stay at these lows. Call a real estate professional you can trust and make a plan before things go even higher.

I know a guy.

Scott C. Dickinson is a real estate broker who lives in beautiful Vancouver, WA but helps others with their real estate needs all over the US. He can be reached by email at ScottYourBroker@gmail.com

or call him at 360-518-7197. Check him out online at his linktr.ee/yourbrokerscott.

Thank you Scott and love the supporting facts- education is key today and it is getting harder and harder to find facts vs fiction.

ReplyDeleteAs I religously track the economic indicators around the mortgage world I came upon an interesting topic.

There is talks about a 50Y bond- which would support making it an option to get a 50Y just like a 30Y 30Y loan. There is some form of them today but more on the private lenders side of things- small market.

If it became mainstream- and came to fruition- it could ROCK the values of homes with todays urrent demand for housing.

Instantly ownership becomes cheaper the rent in majority of places.

A 30Y fixed at 4% on say $380,000 loan amount would be $1814 for only the Principal and interest- pushing it to a 50Y it drops payment to "$1465- dropping a payment by $349.

That $349 is equal to about $70,000 more buying power... see how that payment drop all of a sudden makes owning affordable- and with demand comes price increases.

IF this did happen- we will see another BOOM in prices.

I think it's time for me to get back into some investment property.

The topic of a 50Y bond is intriguing. I like what it for the buying power of our customers out there. Good stuff. Thanks for chiming in.

Delete